On This Page

Unified Checkout Acquirer Implementation Guide

Unified Checkout

Acquirer Implementation GuideThis section describes how to use this guide and where to find further information.

- Audience and Purpose

- This guide is written for Visa Acceptance Platform acquirers and resellers who want to implementUnified Checkoutas part of their Visa Acceptance Platform solution.

- This guide is supplemental to thePlatform Implementation Guidefor Visa Acceptance Platform, which provides general acquirer implementation and administration and the Boarding Guide for API-based merchant and scale boarding requirements.

- Customer Support

- For support information about this product, other products, or the Visa Acceptance Platform, visit the Visa Acceptance Support Center: support.visaacceptance.com

Pilot Release

This document provides information about the pilot release of

Unified Checkout

for acquirer implementation.Recent Revisions to This Document

25.09.01

This revision contains only editorial changes and no technical updates.

25.06.01

Pilot release.

VISA Platform Connect: Specifications and Conditions for

Resellers/Partners

The following are specifications and conditions that apply to a Reseller/Partner enabling

its merchants through

Visa Acceptance platform

. Failure to meet any of the specifications and conditions below is

subject to the liability provisions and indemnification obligations under

Reseller/Partner’s contract with Visa/Cybersource.- Before boarding merchants for payment processing on a VPC acquirer’s connection, Reseller/Partner and the VPC acquirer must have a contract or other legal agreement that permits Reseller/Partner to enable its merchants to process payments with the acquirer through the dedicated VPC connection and/or traditional connection with such VPC acquirer.

- Reseller/Partner is responsible for boarding and enabling its merchants in accordance with the terms of the contract or other legal agreement with the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that all considerations and fees associated with chargebacks, interchange downgrades, settlement issues, funding delays, and other processing related activities are strictly between Reseller and the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that the relevant VPC acquirer is responsible for payment processing issues, including but not limited to, transaction declines by network/issuer, decline rates, and interchange qualification, as may be agreed to or outlined in the contract or other legal agreement between Reseller/Partner and such VPC acquirer.

DISCLAIMER: NEITHER VISA NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR ANY ERRORS OR

OMISSIONS BY THE

Visa Platform Connect

ACQUIRER IN PROCESSING TRANSACTIONS. NEITHER VISA

NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR RESELLER/PARTNER BOARDING MERCHANTS OR

ENABLING MERCHANT PROCESSING IN VIOLATION OF THE TERMS AND CONDITIONS IMPOSED BY THE

RELEVANT Visa Platform Connect

ACQUIRER. Introduction

This guide outlines the steps you should follow to successfully deploy

Unified Checkout

as part of your Visa Acceptance Platform solution.Solution Overview

Unified Checkout

provides a simple and secure checkout solution to protect clients from sensitive data exposure while providing easy access to several payment options: Apple Pay, Google Pay, Click to Pay, Paze, Echeck, and manual card entry.Unified Checkout

provides a single drop-in user interface application to save your merchants from design costs when building payment acceptance on their checkout page.Unified Checkout

is a browser-based solution that merchants integrate using JavaScript within their web page. The customer invokes Unified Checkout

, which creates an iframe on the merchants page and presents the available payment options selected by the merchant. As a browser-based solution, the merchant never has access to the payment information, which significantly reduces their PCI exposure. Unified Checkout

is interoperable with other Visa Acceptance Solutions

products.Unified Checkout is compatible with:

- Authorizations

- Payer Authentication

- Decision Manager

- Token Management Service

Implementation

This section outlines the steps and considerations for your acquirer-level implementation

of

Unified Checkout

as part of your Visa Acceptance Platform solution. The comprehensive Platform Implementation Guide

provides additional information about portfolio ownership and functional usage. Board Merchants with Unified Checkout

Unified Checkout

Unified Checkout

is a product within the acceptance platform. Portfolio owners must enable it for merchants using the boarding API or through the merchant boarding interface in the Business Center.Contact your account or relationship owner if

Unified Checkout

is not available within your portfolio.Implementation Models

Unified Checkout is designed to be flexible and supports multiple integration

options for various deployment scenarios. The implementation models for

Unified Checkout

include:- Integrated directly into merchant web pages

- Integrated into a partners hosted checkout page

Integrated Directly into Merchant Web Pages

Unified Checkout

is integrated directly by each merchant independently and simplifies acceptance on their unique web page.Integration:

- Merchant embedsUnified Checkoutonto their e-commerce page

- The merchant facilitates all the interactions with theUnified CheckoutAPIs

- The merchant generates and leverages the API keys

Boarding:

- You board merchants using their transacting organization IDs toUnified Checkout

- Merchants must enroll in their desired digital payments through the Business Center. Or you enroll merchants in digital payments through the Business Center on behalf of merchants

- Merchants generate API keys to access Unified Checkout APIs

- Merchants integrate Unified Checkout into their web page

Integrated into a Partner's Hosted Checkout Page

You set up

Unified Checkout

in a provider/reseller partner portfolio within a commonly developed application or hosted order page. This deployment serves multiple merchants using the same technology.Integration:

- Unified Checkout is embedded by the partner onto their e-commerce application

- The Partner facilitates all the interactions with theUnified CheckoutAPIs

- The partner leverages Meta Key to use a single key for all merchants

Boarding:

- You board merchants using their transacting organization IDs toUnified Checkout

- Merchants must enroll in their desired digital payments through the Business Center. Or you enroll merchants in digital payments through the Business Center on behalf of merchants

- You generate meta API keys to accessUnified CheckoutAPIs

Boarding API Integration

Enable

Unified Checkout

for your merchants through the boarding

API. Using this method, you send an API request to the Visa Acceptance Solutions

system to set up a merchant without logging into the Business Center.The

Unified Checkout

Integration section in the Merchant Boarding Guide

provides information about using the boarding API for Unified Checkout

.Boarding in the Business Center

Enable

Unified Checkout

for your merchants through the Business Center. To add it while you are adding products for merchants, the system displays

all available products to enable. Under the Payments section, find

Unified Checkout

and select the enable toggle. To add

Unified Checkout

after creating the merchant account, go to

Manage Merchants

and select the appropriate transacting

organization ID.The

Unified Checkout

Integration section in the Merchant Boarding Guide

provides information about using the Business Center for boarding merchants for Unified Checkout

.Digital Payments

When you enable

Unified Checkout

for merchants, the merchant receives

automatic enablement for all digital payment offerings within it. To use digital

payments with Unified Checkout

, merchants enroll with each digital

payment provider before integrating them in their checkout page. - Enablement

- The partner allowing access to the Unified Checkout product for a specific merchant

- Enrollment

- The merchant or portfolio partner acting on behalf of the merchant enrolls in a digital payment option

If you offer the Paze digital payment option for your merchants, enable it

explicitly for each merchant because Paze requires the merchant to sign an

agreement with their acquiring partner.

Paze Configuration for Unified Checkout

Unified Checkout

During merchant boarding in the

Business Center

, complete these steps to enable

Paze.- Click theConfigurebutton forUnified Checkout.

- Check the box forPaze.

- Check thePaze Configurationbox.

The option to select an acquirer appears only if you support multiple Paze acquiring options. Select the acquirer with which the merchant has a Paze contract.

Enrolling Digital Payments

Manage digital pay enrollments in the

Business Center

. The enrollment process

differs for each digital payment depends on the digital payments requirements for

enrollment.Enroll in Apple Pay

Enrolling in Apple Pay registers the merchant with Apple and adds the merchant's page

to Apple's list of domains applicable for Apple Pay. Apple Pay enrollment requires

validation of the merchant's domain. In order to enroll in Apple Pay, a merchant

must download a public certification file and host it on the domain where they have

placed

Unified Checkout

in a public folder.Follow these steps in the

Business Center

to enroll in Apple Pay.- Log into theBusiness Center.

- Go toPayment Configuration>.Unified Checkout

- Click theManagebutton.

- In the Apple Pay section, click theManagebutton.

- Download the Apple Verification Certificate.

- Host the Apple Verification Certificate.

- Click Verify Domain to submit the request for verification.

RESULT

Figure:

Apple Pay Enrollment Page

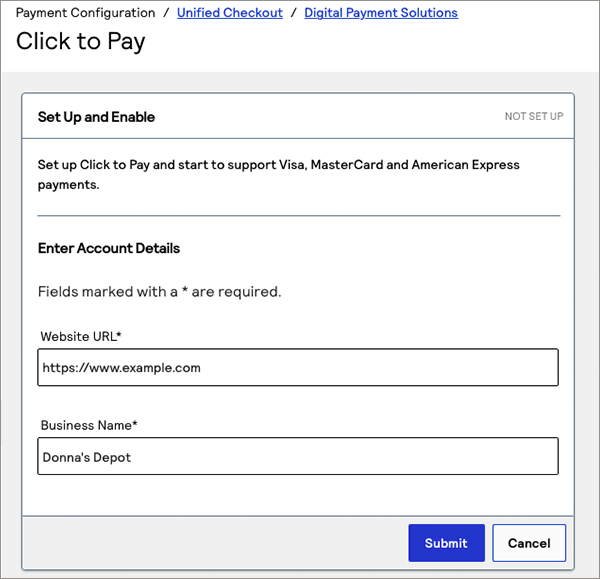

Enroll in Click to Pay

Click to Pay

Merchants must enroll in

Click to Pay

prior to it functioning in Unified Checkout

. This activity registers the merchant with Click to Pay

services for Visa, Mastercard, and American Express.Follow these steps to register the merchant with

Click to Pay

.- Log into theBusiness Center.

- Go toPayment Configuration>.Unified Checkout

- Click theManagebutton.

- In theClick to Paysection, click theManagebutton.

- Provide the website URL and merchant business name.

- ClickUpdate.

RESULT

Figure:

Click to Pay

Enrollment Page

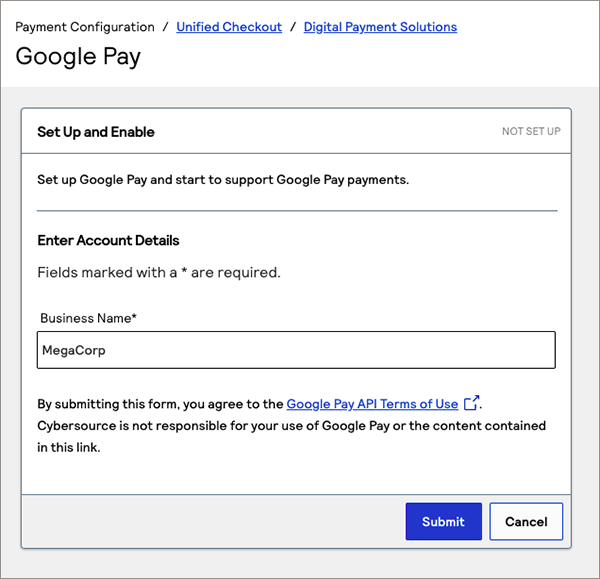

Enroll in Google Pay

Merchants must enroll in Google pay prior to it functioning in

Unified Checkout

.Follow these steps to register the merchant with Google.

- Log into theBusiness Center.

- Go toPayment Configuration>.Unified Checkout

- Click theManagebutton.

- In the Google Pay section, click theManagebutton.

- Provide the merchant Business Name.

- Read the Terms of Use.

- ClickUpdate.

RESULT

Figure:

Google Pay Enrollment Page

Enroll in Paze

Merchants must enroll in Paze prior to it functioning in

Unified Checkout

. This activity registers the merchant with Paze services.Follow these steps to register the merchant with Paze.

- Log into theBusiness Center.

- Go toPayment Configuration>.Unified Checkout

- Click theManagebutton.

- In the Paze section, click theManagebutton.

- Provide the merchant business name and website URL.

- ClickUpdate.

Reference Information

This section contains essential reference information for implementing and operating

the platform. It also provides links to additional technical documentation for

further details.

How to Get Help

As an acquirer distributing Visa Acceptance products, you can reach out to Visa

Acceptance Solutions Support Center.

Go to the Visa Acceptance Solutions Support Center to:

- Search for commonly asked questions, knowledge base articles, and supplemental documentation on the platform and products.

- Enter inquiries or support requests directly into the Support Center.

- View your account specific support resources.

Contacting Client Services

For details, see the Support Center knowledge article at:

How to contact Client Services?

See the Visa Acceptance Acquirer Portal or Development Center for other

product-related documents.