On This Page

Token Management Service Acquirer Implementation Guide

Token Management Service

Acquirer Implementation GuideThis section describes how to use this guide and where to find further information.

- Audience and Purpose

- This guide is written for Visa Acceptance Platform acquirers and resellers who want to implement [product] as part of their Visa Acceptance Platform solution.

- This guide is supplemental to thePlatform Implementation Guidefor Visa Acceptance Platform, which provides general acquirer implementation and administration and the Boarding Guide for API-based merchant and scale boarding requirements.

- Customer Support

- For support information about this product, other products, or the Visa Acceptance Platform, visit the Visa Acceptance Support Center: support.visaacceptance.com

Pilot Release

This document provides information about the pilot release of the

Token Management Service

for

acquirer implementation.Recent Revisions to This Document

25.09.01

This revision contains only editorial changes and no technical updates.

25.07.01

Pilot release.

VISA Platform Connect: Specifications and Conditions for

Resellers/Partners

The following are specifications and conditions that apply to a Reseller/Partner enabling

its merchants through

Visa Acceptance platform

. Failure to meet any of the specifications and conditions below is

subject to the liability provisions and indemnification obligations under

Reseller/Partner’s contract with Visa/Cybersource.- Before boarding merchants for payment processing on a VPC acquirer’s connection, Reseller/Partner and the VPC acquirer must have a contract or other legal agreement that permits Reseller/Partner to enable its merchants to process payments with the acquirer through the dedicated VPC connection and/or traditional connection with such VPC acquirer.

- Reseller/Partner is responsible for boarding and enabling its merchants in accordance with the terms of the contract or other legal agreement with the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that all considerations and fees associated with chargebacks, interchange downgrades, settlement issues, funding delays, and other processing related activities are strictly between Reseller and the relevant VPC acquirer.

- Reseller/Partner acknowledges and agrees that the relevant VPC acquirer is responsible for payment processing issues, including but not limited to, transaction declines by network/issuer, decline rates, and interchange qualification, as may be agreed to or outlined in the contract or other legal agreement between Reseller/Partner and such VPC acquirer.

DISCLAIMER: NEITHER VISA NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR ANY ERRORS OR

OMISSIONS BY THE

Visa Platform Connect

ACQUIRER IN PROCESSING TRANSACTIONS. NEITHER VISA

NOR CYBERSOURCE WILL BE RESPONSIBLE OR LIABLE FOR RESELLER/PARTNER BOARDING MERCHANTS OR

ENABLING MERCHANT PROCESSING IN VIOLATION OF THE TERMS AND CONDITIONS IMPOSED BY THE

RELEVANT Visa Platform Connect

ACQUIRER. Introduction

This guide outlines the steps you should follow to successfully deploy

Token Management Service

(TMS

) as part of your Visa Acceptance

Platform solution.Solution Overview

TMS

is a solution that facilitates and allows your merchants to

tokenize their customers’ sensitive personal information and eliminate payment data from

their networks to ensure that it is not compromised. TMS

tokenizes, securely stores, and manages the primary account number (PAN), the payment

card expiration date, electronic check details, and customer data. TMS

also enables your merchants to create a network token of a

customer's payment card. The purpose of this guide is to help you and your merchants to

create and manage tokens.As an acquirer, you can use

TMS

as TMS

standalone reseller or a TMS

with payments reseller:Figure:

Resellers and Acquirers

- TMSStandalone Reseller

- ATMSstandalone reseller is an organization or business that boards an aggregator merchant into its organization.TMSstandalone resellers can board merchants, enable webhook notifications, and use third party services to process payments.

- TMSwith Payments Reseller

- ATMSwith payments reseller is an organization or business that collaborates withVisa Acceptance Solutions.TMSwith payments resellers can board merchants into their organization and use Visa Acceptance to process payments.

Benefits and Features

TMS

enables your merchants to replace personally identifiable

information (PII), such as the primary account numbers (PANs), with unique tokens. These

tokens do not include the PII data, but act as a placeholder for the personal

information that would otherwise need to be shared.Benefits

TMS

has several benefits for you, the acquirer, and your

merchants:- Tokenization byTMSreplaces sensitive payment data with non-sensitive tokens. This provides a secure payment experience, reduces the risk of fraud, and complies with industry consumer security regulations such as PCI-DSS.

- Network tokens are automatically updated. This reduces the number of declines due to outdated payment credentials and improves both authorization rates and merchant conversion.

Features

TMS

includes these features:- Protect sensitive payment information through tokenization and secure and manage customer data using these token types:

- Customer tokens

- Instrument identifier tokens

- Payment instrument tokens

- Shipping address tokens

- Life-cycle management and notifications when the underlying card of a network token is re-issued. This includes cards that are lost, stolen, or expired. Life-cycle management for network tokens minimizes transaction decline rate and provides a frictionless checkout experience for customers.

Responsibilities and Considerations

This section contains information that informs you of your role, prerequisites, and the

responsibilities of providing services to merchants using

TMS

.Acquirer's Requirements

- You must complete the required portfolio setup tasks. For information, seePortfolio Set-Up Tasksin the Visa Acceptance Platform Implementation Guide

- Before requesting theTMSAPI, you must already have aBusiness Centeraccount. If you do not, you can create an evaluation account. For information, seeRequesting thein theToken Management ServiceAPIToken Management ServiceDeveloper Guide.

Additional Considerations

TMS

is compatible with these products:- Reporting

- For information on the Reporting API, see the Reporting Developer Guide.

- Transaction Search

- For information on the Transaction Search API, see the Transaction Search Developer Guide.

Positioning

This section outlines product usage hierarchy, options for distribution, and sales and

marketing support.

Product Usage in

Hierarchy

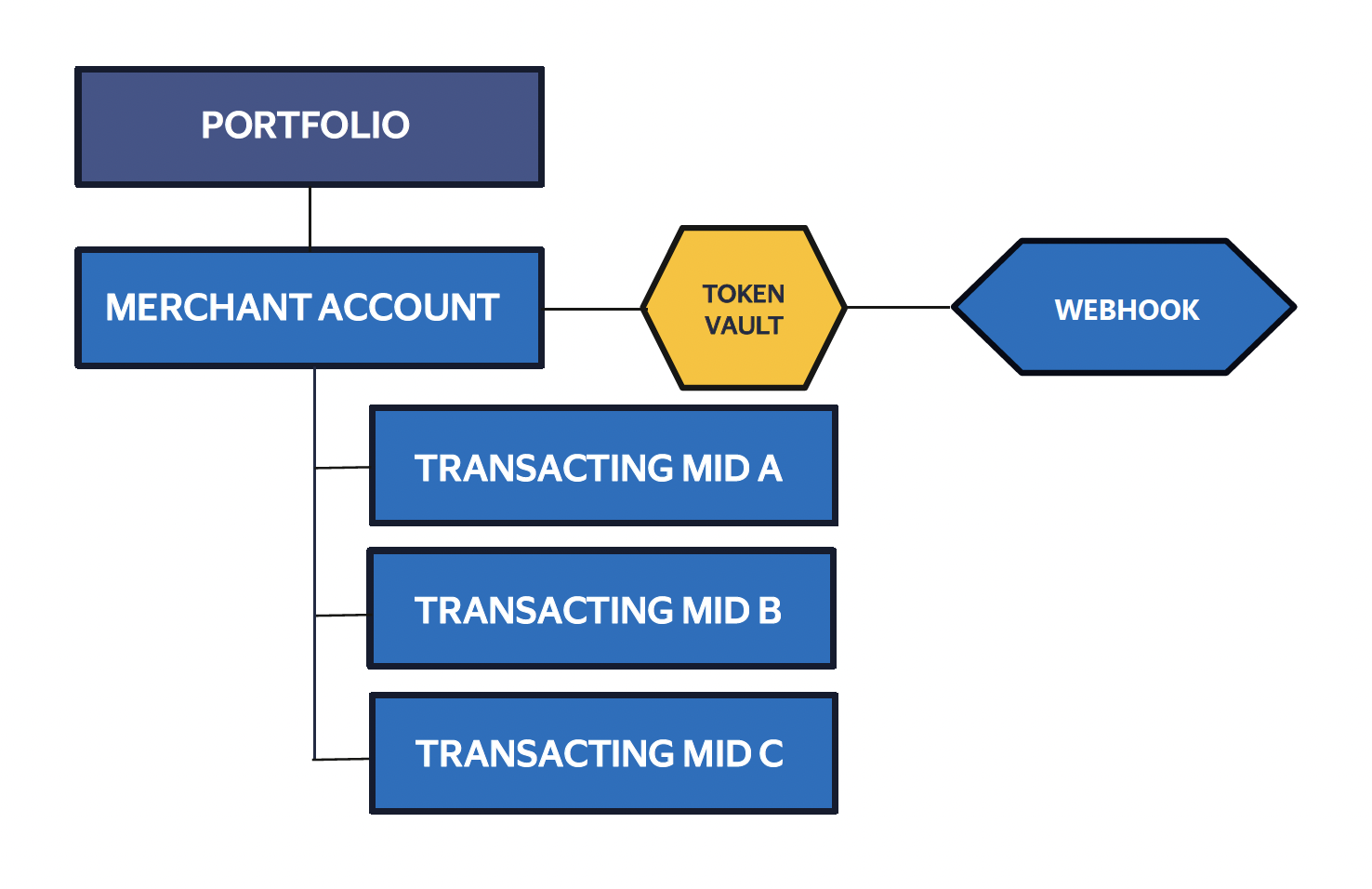

Visa Acceptance Solutions acquirers are onboarded with a three-level hierarchy:

When you board a merchant and enable

TMS

and network tokenization, the merchant of record must be onboarded at the merchant

account level organization where the token requestor ID (TRID) and token vault are

configured. This ensures that the network tokens provisioned are assigned to the

merchant that owns the tokens.Portfolio Hierarchy Descriptions

- Portfolio MID

- This is the parent portfolio MID under which you occupy and board your resold merchant accounts. This portfolio MID is registered with your business information.

- Merchant Account MID

- This is a specific merchant account and represents a resold merchant under your portfolio. This is the level at whichTMSoperates and where theTMStoken vault is configured for token storage. This merchant account MID is registered with the business information of the end merchant that is resold by you.

- Transacting MID

- This is a child MID that is used for processing transactions. A merchant account MID can have multiple transacting MIDs that are boarded beneath it. These represent different processing entities under a merchant account. This transacting MID is registered with the business information for the specific entity that is under the merchant account MID.

Options for Distribution

Implementation models:

- TMSStandalone Reseller

- ATMSstandalone reseller is an organization or business that boards an aggregator merchant into its organization.TMSstandalone resellers can board merchants, enable webhook notifications, and use third party services to process payments.

- TMSwith Payments Reseller

- ATMSwith payments reseller is an organization or business that collaborates withVisa Acceptance Solutions.TMSwith payments resellers can board merchants into their organization and use Visa Acceptance to process payments.

Sales and Marketing Support

Implementation

This section outlines the steps and considerations for your acquirer-level implementation

of

TMS

as part of your Visa Acceptance Platform solution. For

more details on portfolio ownership and functional usage, consult the comprehensive

Platform Implementation Guide

. Understanding Boarding with TMS

TMS

The first step of onboarding with

Visa Acceptance Solutions

to get access to TMS

and its features are to register for a Portfolio account with

Visa Acceptance Solutions

as an acquirer. Once registered, you will then be able

to begin managing your organization and boarding merchant accounts and transacting MIDs.

Merchant accounts and transacting MIDs can then be enabled for TMS

and network tokens.To register for a portfolio on the

Visa Acceptance Platform

you must contact your

account representative.Implementation Models

These are the implementation models for

TMS

:- TMSStandalone Reseller

- ATMSstandalone reseller is an organization or business that boards an aggregator merchant into its organization.TMSstandalone resellers can board merchants, enable webhook notifications, and use third party services to process payments.

- TMSwith Payments Reseller

- ATMSwith payments reseller is an organization or business that collaborates withVisa Acceptance Solutions.TMSwith payments resellers can board merchants into their organization and use Visa Acceptance to process payments.

Boarding API Integrations

Enable

TMS

for your merchants through the boarding API. Using

this method, you send an API request to the Visa Acceptance Solutions

system to set up

a merchant without logging into the Business Center

.The

TMS

section in the

Merchant Boarding Guide

provides information about using the boarding API for

TMS

.You can also refer to the Merchant Boarding section of the API Reference

in the

Visa Acceptance Solutions

Developer Center for information about Boarding API

integrations.Setting up the Portfolio

As the portfolio administrator, you must complete the initial set-up tasks when logging

into your portfolio account for the first time. For information about setting up your

portfolio, see Portfolio Set-Up Tasks in the .

Visa Acceptance Platform

Implementation GuideOnce you have set up your portfolio MID and a user account for the portfolio log-in,

you can begin boarding your resold MIDs to activate them for

TMS

and network tokenization.Boarding a Merchant Account and Transacting MID

Follow these steps to board a merchant account and transacting MID in your organization:

- Log in to the test environment or production environment.

- Test:https://businesscentertest.visaacceptance.com

- Production:https://businesscenter.visaacceptance.com

- In the left navigation panel, clickPortfolio Management.

- Under Merchants, clickManage Merchants. The Manage Merchants page appears.

- Click+ Add Merchant.

- Select where you want to board your merchant:

- SelectBoard a new merchant accountto create a new merchant account.

- SelectAdd to an existing accountto add a transacting merchant to an existing merchant organization.ClickNext.

- If you are adding a transacting organization to an existing merchant account, search for the merchant account in the Boarding Presets section.

- If you have more than one boarding package, choose a boarding package from the drop-down menu, or enter text in the search field to find one. ClickNext. If you have only one boarding package, the Boarding Package section does not display.

- ClickStartin the Merchant Account Information section to enter account information.

- Optional: clickSkipin the Hierarchy Details section to skip the hierarchy step.

- ClickStartin the Transacting Organization and Products section to set up a transacting organization and configure products for it. The Transacting Organization and Products page appears.

- Under Transacting Organization Details, enter the transacting organization name and the organization ID.

Enabling TMS for an Existing Merchant Account

TMS

for an Existing Merchant AccountFollow these steps to enable

TMS

for an existing merchant account:- In the left navigation panel, clickPortfolio Management.

- Under Merchants, clickManage Merchants. The Manage Merchants page appears.

- Search for the organization on the Manage Merchant page.

- Find the organization in the Search Results table, and click the eyeball icon. The Merchant Details page appears.

- In the Products section, click+ Add Products. The Add a Product page appears.

- Under Commerce Solutions, select Token Management Service. ClickAdd. The Token Management Service page appears.

- In the Product Configuration Template drop-down menu, select your template.

- ClickApplyto save your configuration.

Configure Network Tokenization

Follow these steps to configure merchant token vault network tokenization settings:

- Log in to the test environment or production environment.

- Test:https://businesscentertest.visaacceptance.com

- Production:https://businesscenter.visaacceptance.com

- In the left navigation panel, click theToken Managementicon (

).

- ClickVault Management New. The Vault Management page appears.

- Select the vault owner that you want to configure from the Vault Owner drop-down list.

- In the Details column, clickNetwork Tokenization. The Network Tokenization page appears.

- On the VISA tab, switch theEnroll to VISA Token Servicesbutton to On to enable Visa token services. The required business information for the merchant information will be populated:

- Merchant name

- Website URL

- Country code

- ClickOnboard with Acquirer IDand enter the required information:

- Acquirer ID: Set the value to40010052242. This is a static acquirer ID that is used forTMS.

- Acquirer merchant ID: Enter your organization ID.

- ClickManage Details.

- >CheckEnable Visa Token Provisioningto enable Visa network token provisioning.

- >CheckEnable Visa Token Transactionsto enable Visa transaction processing using network tokens.

- Enter the token requestor ID (TRID) if necessary:

- TRID

- Relationship ID

- On the MASTERCARD tab, switch theEnroll to MASTERCARD Token Servicesbutton to On to enable Mastercard token services.

- ClickManage Details.

- CheckEnable Mastercard Token Provisioningto enable Mastercard network token provisioning.

- CheckEnable Mastercard Token Transactionsto enable Mastercard transaction processing using network tokens.

- Enter the token TRID if necessary:

- TRID

- Relationship ID

- On the AMERICAN EXPRESS tab, switch theEnroll to AMERICAN EXPRESS Token Servicesbutton to On to enable American Express token services.

- CheckEnable American Express Token Provisioningto enable American Express network token provisioning.

- CheckEnable American Express Token Transactionsto enable American Express transaction processing using network tokens.

- Enter the token TRID if necessary:

- TRID

- SE number

- ClickSubmitto save your settings.

Meta Keys

Portfolio organizations that send requests to the TMS

API on behalf of their transacting merchants can create Meta

keys. Meta keys are used to transact on behalf of their multiple transacting MIDs with a

single key. For more information on Meta keys, see Meta Key Creation and Management in the

Creating and Using Security Keys

developer guide.Reports

This section describes how to create, view, and manage reports in the

Business Center

. Reporting is crucial to the success of you and your merchants.

The Business Center

offers several options for accessing and downloading

your transaction data: - Payment Batch Summary Report

- A report that tracks the processed payment data of your managed merchants, such as total sales and refunds by currency and payment method.

- Reports

- Reports can be generated using preconfigured settings or by configuring your own custom settings. These reporting options are known as:

- Custom reportsthat you create for your organization's reporting needs.

- Standard reportsthat track and reconcile payment activity using preconfigured settings and require no setup.

The type of transaction information generated by these reports is determined by the report type. Some report types can only be produced by a portfolio-level user while other report types may only be accessible at the merchant account level. The report types available depend on the services enabled in your portfolio. An individual user's access to available reports depends on the account permission levels in theBusiness Center.

Reports contain personal identifiable information (PII). Any

individual who is given permission to view reports has access to this

information.

- Reporting Using theBusiness Center

- For detailed information about reporting using theBusiness Center, see theReporting User Guide.

- Reporting API

- If you, as a partner, would like to automate your generated reports, see theReporting Developer Guide.

Token Vault Management

Token vaults are where merchants store their customer and payment data. A

Business Center

internal user can enable the TMS

vault. Vaults are assigned to an owner, and all data within the vault belongs to the owner. You

can grant permission to individual MIDs to create, retrieve, update, and delete tokens

within a vault. Created tokens belong to the owner of the vault, not the creator of the

token. If you remove a MID from a vault, it can no longer access any tokens within that

vault, including tokens created under that MID.

It is not currently possible to merge vaults, so ensure that

merchants are set up with the correct vault by creating a new vault or granting access

to an existing vault.

Token Requestor IDs

A token requestor ID (TRID) is a unique identifier that entities such as merchants use to

request network tokens from token providers. Having a TRID is a prerequisite for

enabling network tokenization.

Each entity must register with the token provider to get a TRID. Contact a

Visa Acceptance Solutions

representative to enroll a merchant as a token requestor.Visa and Mastercard TRIDs

An internal user can enroll a merchant as a VISA or Mastercard token requestor

through the

Business Center

.Follow these steps to enroll a merchant as a token requestor in the

Business Center

:- Log in to the test environment or production environment.

- Test:https://businesscentertest.visaacceptance.com

- Production:https://businesscenter.visaacceptance.com

- Navigate toToken Management.

- ClickVault Management.

- Use the Vault Owner filter to search for the merchant account that hasTMSenabled.

- Choose the merchant account to view theTMSvaults that are configured for the merchant.

- ClickNetwork Tokenization.

- ClickEnroll to VISA/Mastercard token services.

- Enter the required information for each card type:

- Mastercard

- Business entity name

- Visa

- Merchant name

- Merchant website URL

- Merchant country code

- ClickOnboard with Acquirer ID.

- Enter the required information:

- Acquirer ID

- Set the value to40010052242. It is a static acquirer ID that is used forTMS.

- Acquirer Merchant ID

- Enter your organization ID.

- ClickEnroll to Network Token Servicesto complete enrollment.

In order to request a TRID from the token provider,

Visa Acceptance Solutions

uses

merchant business details already stored. If any of the details are not present, a

dialog form should appear prompting you to complete the missing information.American Express TRIDs

Enrollment as a token requestor for American Express is a manual process. Contact

your

Visa Acceptance Solutions

representative to request the TRID for American

Express. Allow 2 to 3 days for the completion of your request.

Service establishment (SE) Numbers

are required in order

to process American Express card transactions.Distribution and Integration

Use Visa Acceptance Platform to provide and distribute

TMS

to

your solution portfolio. The rest of this document focuses on your role in enabling

TMS

and providing support resources.Resources for Merchants

This guide contains links and examples from the

Token Management Service

Developer Guide

and API requests from the Token Management Service

Developer API Reference. Refer to

these resources in full to explore all the Token Management Service

end-to-end integration flows:Merchant Management

This section describes how to create and manage merchant accounts in your portfolio. When

you finish setting up, your merchants can process payments.

Merchant management consists of two tasks:

- Creating templates that determine how your merchants use your enabled services.

- Adding merchants within your organization that can use your enabled services.

Visa Acceptance Platform

recommends that you perform merchant management tasks in

your test portfolio account first, and when you are ready, duplicate these tasks in your

production portfolio account.Merchant Management Tasks

Complete these tasks to create, configure,

and test merchant accounts in your portfolio:- Create a set of templates for all of the services enabled for your portfolio.

- Create a merchant account.

- Perform a payment transaction for one or more of the services enabled for your portfolio.

- Provide your merchants with theirBusiness Centeraccount credentials and the instructions they need to use their account

Administration Functions

Assign a Portfolio Administrator

Assign a

portfolio administrator

who can take ownership of the partner

portfolio. It is the portfolio administrator who should be the first member of your

organization to log in to the Visa Acceptance Solutions

Business Center

.The portfolio administrator is responsible for the complete solution and experience

for the shared merchants. For the merchant experience within the solution, it is the

portfolio administrator who helps define the solution architecture, operational

management of the solution, as well as the implementation and support program.

First Time Logging In

The portfolio administrator should log in first in order to take these actions:

- Create roles and users for your operations team.

- Ensure that the requested solutions are enabled for the portfolio.

- Enable merchant templates and merchant accounts.

If the person who receives the initial login credentials is not the portfolio

administrator, then a

user

account must be created for the portfolio

administrator with their role set to administrator. The administrator role is a

default role that has all privileges and access to all features within a

portfolio.Merchant Switch

Switching merchants enables you to perform actions on behalf of any merchant account

that you have access to. For example, if you are acting in a support capacity, you

might receive a call from someone in an organization asking how to perform an

action. By switching merchants, you can do it for them during that call and explain

how to do it in the future from their view.

When you switch merchants, only the features enabled for that merchant account are

visible. Only the information allowed by the permissions assigned to that account or

user are visible. To limit the dataset for a quicker search, using the smaller set

of information accessible for that account can be helpful.

Follow these steps to switch merchants:

- Select the merchant account to which you want to switch. The Merchant Details page appears.

- At the top of the screen, click the Switch View drop-down menu and selectChoose Organization. The Switch View sidebar displays.

- ClickQuickto simply enter the name of the organization and then clickSwitch view, or clickCustomto search for an organization.

- If you chose a custom search, begin by selecting the organization type from the Organization Type drop-down menu.

- If you know the exact organization ID or name, enter them into the Organization ID and Organization Name text fields.

- If you do not know the exact name or organization ID of the organization, enter partial text and clickShow organization. Then select the organization from the Organization drop-down menu.

Transaction Support

- Webhooks

- Manage Webhook Subscriptions section of theToken Management ServiceDeveloper Guide

- Reporting

Billing and Invoicing

To ensure that you pay your portfolio account bill on time to Visa, set up your automatic

bill payment before the end of the next

Visa Acceptance Platform

billing cycle. To

do this, set up automatic payments in the Business Center

and, if required,

verify that your accounts payable team is set up to process Visa Acceptance Platform

billing invoices for payment. Setting up your billing invoice for automatic payments

helps you to avoid late fees. Contact your Visa Acceptance Platform

sales

representative for any questions.If automatic payments are not supported in your region, use the

Business Center

one-time payment capability to pay your portfolio account's monthly bill.Automatic payments and billing are not available in the test environments.

For more information about billing and invoicing, see Bill Payment Set-Up in the .

Visa Acceptance Platform

Implementation GuideReference Information

This section contains essential reference information for implementing and operating

the platform. It also provides links to additional technical documentation for

further details.

How to Get Help

As an acquirer distributing Visa Acceptance products, you can reach out to Visa

Acceptance Solutions Support Center.

Go to the Visa Acceptance Solutions Support Center to:

- Search for commonly asked questions, knowledge base articles, and supplemental documentation on the platform and products.

- Enter inquiries or support requests directly into the Support Center.

- View your account specific support resources.

Contacting Client Services

For details, see the Support Center knowledge article at:

How to contact Client Services?

See the Visa Acceptance Acquirer Portal or Development Center for other

product-related documents.